The Best CFD Trading Platform: A Comprehensive Guide

In the ever-evolving landscape of financial markets, choosing the best cfd trading platform best CFD brokers for trading contracts for difference (CFDs) can significantly impact your trading success. This guide aims to aid both novice and experienced traders in identifying the best CFD trading platforms available today. With numerous options on the market, it’s essential to understand what features and factors to consider when selecting the platform that best suits your trading style and financial goals.

Understanding CFDs

Contracts for difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of various assets, such as stocks, commodities, indices, and currencies, without owning the underlying asset. This type of trading provides numerous advantages, including leverage, which enables traders to control a larger position with a smaller amount of capital. However, with the potential for increased reward comes increased risk, making it crucial for traders to choose a reliable trading platform.

Key Features of the Best CFD Trading Platforms

When searching for the best CFD trading platform, traders should consider several key features:

1. Regulation and Security

One of the foremost considerations is whether the platform is regulated by a reputable financial authority. Regulation ensures that the broker adheres to strict operational standards and provides a level of security to traders. Look for platforms regulated by organizations such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

2. User-Friendly Interface

The trading platform’s interface should be intuitive and easy to navigate. A user-friendly design allows traders to execute trades effectively, analyze market trends, and manage their portfolios without frustration. Some platforms offer demo accounts, allowing traders to familiarize themselves with the interface before committing real capital.

3. Trading Tools and Resources

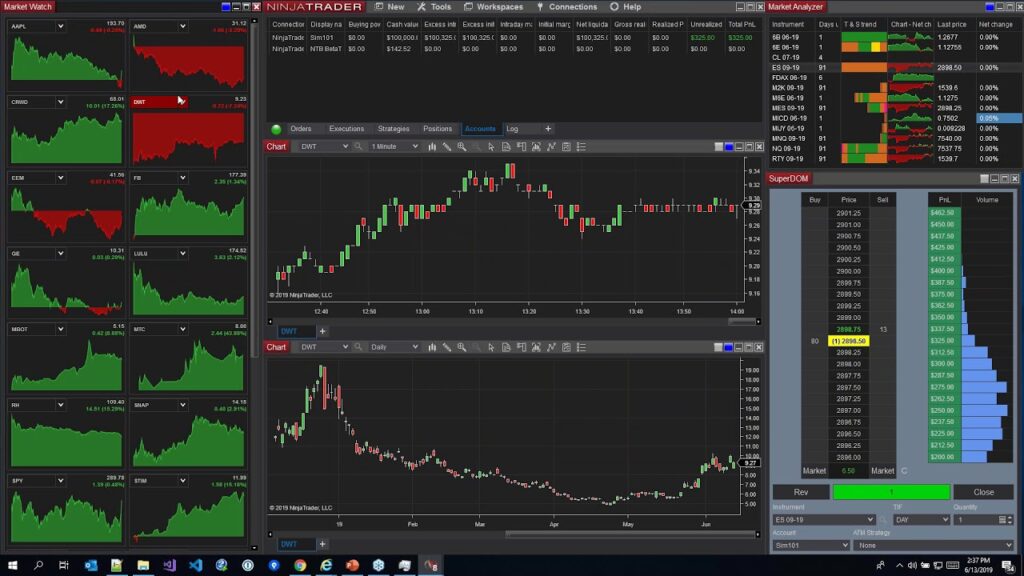

Quality trading tools can significantly enhance a trader’s experience. Look for platforms that provide advanced charting tools, technical analysis indicators, and access to real-time market data. Educational resources, such as webinars, articles, and tutorials, are also useful for both new and experienced traders seeking to refine their skills.

4. Variety of Financial Instruments

The best CFD trading platforms offer a wide range of trading instruments. This variety allows traders to diversify their portfolios and explore different market opportunities. Check if the platform offers CFDs on stocks, indices, commodities, cryptocurrencies, and forex pairs to ensure it meets your trading preferences.

5. Pricing Structure

Understanding the pricing structure is critical when evaluating CFD trading platforms. Look for transparent fee structures, including spreads, commissions, and overnight funding charges. Some platforms may offer zero-commission trading, but it’s essential to verify whether this is balanced out by wider spreads.

Top CFD Trading Platforms of 2023

Here are some of the best CFD trading platforms available in 2023:

1. eToro

eToro is renowned for its social trading features, allowing users to follow and copy the trades of successful investors. It provides an intuitive interface and a wide selection of assets, making it suitable for beginners and experienced traders alike. With robust regulatory oversight, eToro has become a popular choice globally.

2. IG Group

IG is a well-established CFD broker that offers a vast range of financial instruments, from forex to cryptocurrencies. Its easy-to-use platform is complemented by excellent educational resources, helping traders improve their skills. IG also provides competitive spreads and is regulated by respected authorities, ensuring a high level of security.

3. Plus500

Plus500 is known for its simple and effective trading platform, which caters to both beginners and advanced traders. The platform offers a wide variety of CFDs, and its commission-free structure attracts many traders. Plus500 is regulated by multiple financial authorities, ensuring a trustworthy trading environment.

4. AvaTrade

AvaTrade boasts a diverse range of trading platforms, including mobile apps and web trading solutions, catering to different trading preferences. It offers competitive spreads across various asset classes and features educational resources for traders of all levels. AvaTrade’s regulated status adds an extra layer of security.

5. CMC Markets

CMC Markets is renowned for its advanced trading tools and comprehensive market analysis. The platform provides access to a wide range of CFDs, with competitive pricing and low fees. Its educational resources and demo account options are excellent for traders looking to refine their strategies.

Conclusion

Choosing the best CFD trading platform is an essential step for anyone interested in trading CFDs. By considering factors such as regulation, user interface, trading tools, pricing structure, and the variety of instruments offered, you can find a platform that aligns with your trading goals. Platforms like eToro, IG, Plus500, AvaTrade, and CMC Markets are all worth considering in your search for the best CFD trading platform. Remember to conduct thorough research, utilize demo accounts, and continuously educate yourself as you navigate the exciting world of CFD trading.