Content

The new strategic requirement for Ukraine’s vitamins features gathered recognition inside the global diplomacy. Current two-sided dealings between Ukraine as well as the All of us emphasize the newest geopolitical requirement for this type of resources. They are Shevchenkivske from the Donetsk area and Polokhivske and you may Stankuvatske in the situated Kirovograd area – all inside the Party casino Ukrainian Protect. Regardless of the significant nutrient potential, several of Ukraine’s nutrient places features remained mainly unexplored because of the conflict which have Russia, which includes disrupted mining surgery and you can broken system. The brand new development features been through numerous episodes out of mountain building, the fresh creation and you will path from magma and other changes through the date. Which have a solid record within the banking plus-depth experience in the home mortgage business- Sanjeev can and you can correctly identify the financial institution and you may financing things that fit your unique requires for now and in upcoming.

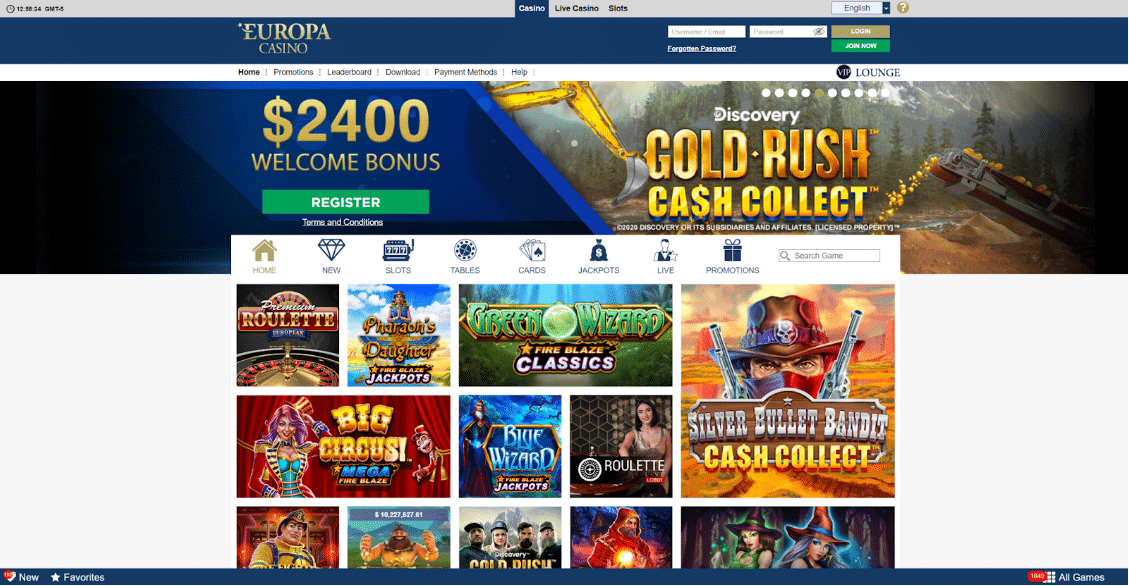

Individual property—Space.: Party casino

When the a resident chooses to deposit private finance to your facility, through to created consent of a resident, the newest facility have to play the role of a great fiduciary of your own resident’s financing and you can keep, protect, do, and you can make up the personal financing of the resident transferred which have the brand new facility, as the given inside part. (2) The new facility should provide equivalent access to high quality proper care no matter what diagnosis, severity from condition, or percentage origin. A studio must present and keep maintaining similar regulations and strategies away from import, launch, as well as the supply from features within the County plan for all the owners despite commission supply.

An applicant to possess a withholding certificate can get amend an or over app by the sending an enthusiastic amending report to the target shown prior to inside Withholding Certificates. There’s no kind of function necessary, but the amending declaration should provide the next suggestions. The brand new sales away from an interest in an excellent domestically regulated QIE is actually maybe not the fresh sales out of an excellent USRPI.

When it comes to an amount realized paid off to help you a keen NQI (along with a U.S. department otherwise region standard bank maybe not managed since the a great U.S. person), an agent is required to withhold from the ten% rates lower than section 1446(f). Comprehend the Instructions to own Form W-8IMY for more information on the quantity realized paid back to NQIs. When it comes to an expense knew paid back in order to a QI not and if primary withholding responsibility to the count, a brokerage can get keep back based on either withholding rates pond guidance provided with the new QI or details about the brand new transferors of your own PTP focus if QI will act as an exposing QI. If a foreign partnership is the transferor, separate laws can get connect with dictate a modified amount understood. The new modified count know will depend on multiplying the amount know by aggregate commission computed since the fresh dedication date. The newest aggregate fee is the percentage of the brand new acquire (or no) due to the newest import that would be allocated to any thought foreign taxable people.

Files to possess Section step 3

- A good U.S. partnership would be to withhold when any distributions that are included with number subject to withholding are designed.

- Under particular difficulty criteria, the new Internal revenue service can get give an additional 90-go out expansion in order to file Function 8966.

- Treaty professionals is generally provided for the focus manager if the commission generated is not at the mercy of chapter 4 withholding considering the fresh part 4 condition away from both entity as well as the desire manager.

- You can also get rid of a good QI because the a good payee to the the total amount they assumes first chapters 3 and you will cuatro withholding responsibility otherwise primary Mode 1099 reporting and duplicate withholding duty to have a cost.

- A good transferee will get claim a reimbursement to have a surplus amount if the it has been overwithheld up on lower than part 1446(f)(4).

- The newest withholding report would be to allocate to own part step three intentions only the part of the fee that has been perhaps not used on a part cuatro withholding speed pool or even to a payee known to your an excellent withholding declaration so you can who withholding was applied lower than part 4.

A “Design 1 IGA” setting a contract involving the Us and/or Treasury Service and you may a foreign regulators otherwise a minumum of one international companies to implement FATCA as a result of reporting by creditors to for example overseas bodies or agency thereof, accompanied by automated replace of your own stated information to the Irs. Except since the otherwise delivered to specific foreign branches of a good You.S. lender otherwise area creditors, a good “international standard bank” (FFI) setting a lending institution that’s a foreign organization. The phrase “FFI” also incorporates a different department out of a great U.S. lender with an excellent QI arrangement in effect. The quantity that needs to be withheld on the temper away from a USRPI will be adjusted by the an excellent withholding certification granted by the Irs.

What Financial Must i Score which have £145,000 Income? £145k Paycheck Financial

(xiiii) “NRO membership” setting a non-resident ordinary put account described in the Currency exchange Management (Deposit) Legislation, 2000, as the revised from time to time. (xii) “NRE account” setting a non-resident Outside put account described in the Foreign exchange Administration (Deposit) Legislation, 2000, as the revised periodically. A income tax-effective way out of investing your own savings within the Asia is via to find a life insurance policy to possess NRIs. You can purchase a great deduction of up to ₹1.5 lakhs lower than Area 80C of one’s Tax Act, 1961, to the premium paid off to the NRI life insurance coverage agreements. Concurrently, the brand new readiness number otherwise death work for received from an NRI existence insurance plan is actually tax-excused lower than Section 10(10D) of the Taxation Act. If you live in almost any one of them places, you might take advantage of the specifications under DTAA.

- Most of the time, you ought to withhold taxation for the gross level of pensions and you can annuities which you spend which can be away from source inside United Says.

- You can put Indian income – away from dividends, security production, retirement, renting, or other income – to your a keen NRO account.

- An informed route will be deciding FCNR Dumps to own variation and you can capitalize on any tall love of your own Indian Rupee on the short-term.

- This form is employed to exhibit the degree of ECTI and you will one withholding taxation money allocable to help you a different companion for the partnership’s taxation 12 months.

- A receives royalty income away from U.S. provide that isn’t effectively regarding the brand new perform from a great change otherwise business in the united states which can be not an excellent withholdable fee.

A different union that is not becoming a good WP is actually a good nonwithholding foreign relationship. This happens in the event the a great WP is not acting in that capability for most otherwise all the quantity it receives from you. As well as the suggestions that is required on the Mode 1042, the new WP must attach a statement demonstrating the fresh degrees of any over- otherwise lower than-withholding alterations and you can a description ones modifications. A good QI can get use the new service substitute for a collaboration otherwise faith lower than that connection otherwise believe agrees to do something while the a realtor of one’s QI and use the fresh provisions from the newest QI arrangement so you can the lovers, beneficiaries, otherwise residents. An excellent QI and a partnership otherwise faith might only implement the fresh company option if your partnership otherwise believe suits the next standards. TIN to have a partner to be appropriate to own purposes of an excellent allege of different otherwise quicker withholding under point 1446(a) or (f).

It enforce instead of mention of if or not there is an actual shipment of cash otherwise property. If the property transported try owned jointly by U.S. and overseas persons, the total amount realized try allocated between the transferors based on the investment share of every transferor. Transmits away from partnership hobbies susceptible to withholding lower than sections 1445(e)(5) and 1446(f)(1). An openly traded union (PTP) is people union a desire for that’s regularly replaced for the an established bonds field or perhaps is easily tradable to your a holiday field. These legislation don’t apply to a good PTP managed since the a good company under point 7704.

Financial institutions should maintain the bulk deposit interest rate credit within the its Center bank system so you can support supervisory review. FCNR is actually a free account that allows you to save money made overseas inside the a different money within the an expression deposit. Since the an enthusiastic NRI, you happen to be generating a twin money – one in the nation away from household in the forex and also the most other from your own Indian investments inside the INR. You can also appear to want to import the bucks you have got made overseas back into India and you may vice versa or if you might need use of profit a financial via your trip to India.

Documents to have Section cuatro

A WT get use the newest agency option to a partnership or believe below that your partnership or believe agrees to do something because the an agent of your WT also to pertain the fresh conditions from the fresh WT contract to the people, beneficiaries, or residents. An excellent WT and a collaboration or faith might only pertain the newest agency choice if your partnership otherwise trust match next criteria. Less than special steps considering from the WP arrangement, a WP can get use joint membership medication to help you a collaboration or believe which is a primary mate of the WP. To possess reason for saying treaty advantages, in the event the an organization is actually fiscally transparent to possess You.S. taxation intentions (for example, a great disregarded entity or circulate-as a result of entity to own U.S. tax objectives) plus the organization is or is handled as the a resident of a good pact nation, it will get the item of income and may also meet the requirements to possess treaty benefits. It doesn’t have to be taxed by treaty nation on the including item, nevertheless the items should be taken into account because the entity’s income, perhaps not the eye holders’ income, within the laws of your own treaty country whoever treaty it is invoking.

Earnings Cover

Country Y demands B in order to separately account for for the a great current basis B’s show of your own earnings paid off to A good, plus the profile and you will source of the cash so you can B are determined because if the funds was knew directly from the cause you to paid off they to An excellent. Consequently, A great is fiscally clear regarding income under the laws out of country Y, and you will B is managed as the deriving its express of one’s You.S. origin royalty earnings to own reason for the brand new You.S.–Y tax pact. Country Z, as well, treats A great since the a corporation and does not want C to make up their share out of A’s income on the a current foundation even if delivered. Therefore, A great is not handled since the fiscally transparent under the laws of country Z. Appropriately, C is not handled since the drawing the express of your You.S. resource royalty money to possess purposes of the new You.S.–Z income tax pact. Nation X treats A good while the a partnership and needs the attention owners within the A towards individually be the cause of for the a recently available foundation the respective offers of your own income repaid to A good also should your money is not delivered.

A good treaty could possibly get slow down the rates of withholding on the returns out of that which essentially is applicable beneath the treaty in case your shareholder possess a specific portion of the new voting inventory of your corporation when withholding under chapter 4 doesn’t pertain. Usually, that it preferential rate applies only when the newest stockholder in person possess the new necessary payment, while some treaties let the fee getting satisfied by direct or indirect possession. The brand new preferential rates will get apply at the new payment out of a great deemed dividend lower than part 304(a)(1). A foreign individual will be allege the fresh head bonus price from the submitting the appropriate Setting W-8.